Trading Psychology and the Importance of Psychological Fortitude

Most of us believe that trading is all about numbers, strategies, and market analysis. But today, a series of unfortunate events reiterated to me that it’s as much about mental state as it is about mechanics. My saga began with a seemingly trivial decision: whether to close a balcony door. This seemingly innocuous decision, fueled by my care for Icy, my dog, led to a cascade of events, all of which heavily impacted my trading decisions and results.

First came the mosquito onslaught, then sleep deprivation, followed by health concerns with my other dog, Heli. All these factors, while unrelated to trading, directly impacted my psychological state, which in turn, affected my trading performance.

The Zero-Sum Game of Trading

Every trader needs to recognize that trading is a zero-sum game. When you profit, someone else takes a loss. This isn’t a playground; it’s an arena where you’re up against some of the sharpest minds globally.

However, the true challenge isn’t just deciphering market movements or predicting trends. It’s battling internal dilemmas, maintaining emotional balance, and making decisions with a clear mind.

Why Mental Clarity is Paramount

Today’s first trading decision — diving into the London Session after a restless night — was an error in judgment. It cost me $500 USD. It wasn’t the strategy or the market conditions that were at fault, but my compromised mental state. This underscores the crucial link between mental clarity and trading success.

Then came a series of external issues, further clouding my judgment: problems with the water bill, prolonged waiting times, and poor customer service experiences. Just when the day seemed overwhelming, the market presented an opportunity — an ICT Silver Bullet Setup. It was a chance to recuperate losses, and I took it. Although profitable, I exited early, losing out on potential earnings.

A Deeper Look into the Silver Bullet Trade

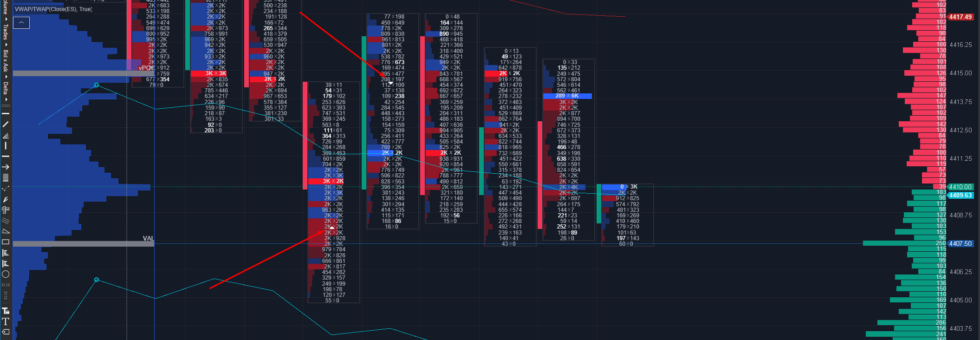

As the day moved into the PM session, I was drawn to the charts once more. It’s often said that in trading, patterns and opportunities are like buses; if you miss one, another will soon come around. And there it was, the ICT Silver Bullet Setup, forming right in front of my eyes. This wasn’t just any setup; it was a trade opportunity many traders dream of capturing.

Trade Levels and Expectation

Upon closer inspection, the levels were too enticing to ignore. I entered at 4408. It’s essential to understand why this specific level piqued my interest. The market had shown prior support around this region, and the confluence of indicators signaled that a bullish move was imminent. My target? 4417.25. This wasn’t just a random number plucked from the air. Historical data, combined with the Silver Bullet Setup dynamics, indicated that this level was attainable. The potential for a 37-tick gain was right there.

Now, trading isn’t just about entering and exiting. It’s about expectations. My expectation for this trade was based on the solid groundwork I had laid down in studying, understanding the market nuances, and the unmistakable signs that the Silver Bullet Setup presented. I was confident, but as any seasoned trader will tell you, the market has a mind of its own.

Trading Psychology: The Emotional Rollercoaster and Decision to Exit

Despite everything lining up perfectly, the emotional journey was about to take a wild turn. With each tick movement, the weight of the morning’s losses and the day’s trials became increasingly evident. As the price moved in my favor, a part of me began second-guessing the decision. Would the market reverse? Was this just a temporary rally before a sharp decline? These questions, fueled by the day’s earlier chaos, began to cloud my judgment.

Then, as the market moved 25 ticks in my favor, equating to a gain of $625 on 2 ES contracts, I decided to exit. On the surface, this might seem like a knee-jerk reaction, especially when the trade could have yielded an additional $300. But here’s the thing: my psychology for the day was battered, and while the technicals provided one story, my emotional state painted another.

When analyzing this trade, it wasn’t just about the technical levels or market dynamics. It was a battle of wits against my own emotions. Exiting the trade early was not a result of what the charts said but a testament to the earlier point: psychology in trading is paramount. While I might have left money on the table, the decision underscored the importance of trading in the right mindset.

In reflection, while the Silver Bullet Trade was profitable, it also served as a stark reminder. Profits and losses are part and parcel of a trader’s journey, but mastering one’s emotions and psychology? That’s the real key to long-term success.

Understanding Our Psychological Limitations

Today’s experiences offer three invaluable lessons:

- Self-awareness: Recognize when you’re not in the right frame of mind. There’s no harm in stepping back for a day. Remember, preserving capital — both financial and mental — is sometimes more crucial than chasing potential profits.

- Building Resilience: Every experience, good or bad, is an opportunity to learn and grow. Embracing challenges makes you more resilient, better preparing you for future trades.

- Constant Vigilance in Execution: When we’re competing with the world’s best traders, every decision counts. Even a winning trade can have flaws in its execution. Always review, refine, and strive for perfection.

Conclusion: The Mind Matters

In essence, while trading strategies and market knowledge are vital, understanding and mastering one’s emotions and psychological state can be the game-changer. Today’s series of events, from mosquito attacks to mechanical issues with elevators, might seem disjointed, but they all culminated in impacting trading decisions.

Every aspiring trader should invest time in understanding their psychological triggers and working towards mental clarity and emotional balance. After all, in the high-stakes world of trading, ensuring your mind is your ally can be the most potent strategy of all.