FVG - Fair Value Gap by ICT

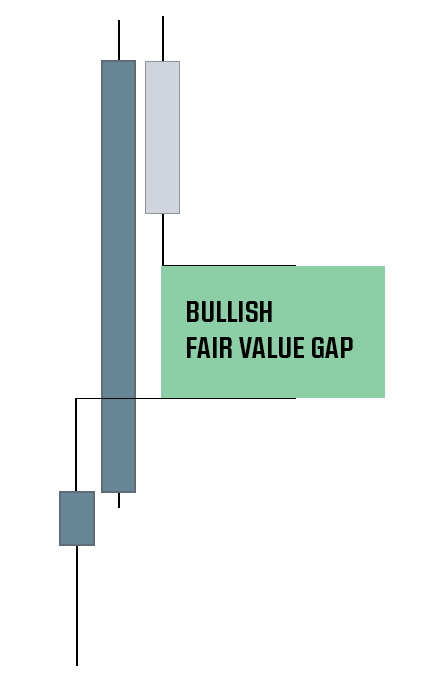

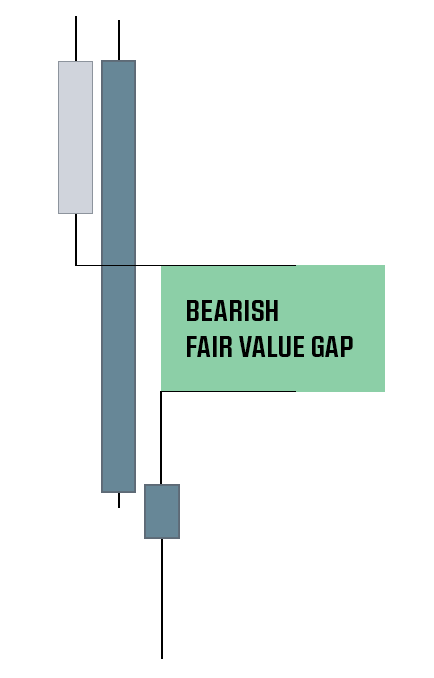

The Fair Value Gap is a three candle stick pattern. The low of the first candle doesn’t overlap with the high of the third candle, or the high of the first candle doesn’t overlap with the low of the third candle.

The Idea behind the FVG is, that the price trends to go to the Fair Value Gap. And the FVG is a resistance level for the price. This level can be broken by a wick, but not by a full candle close.

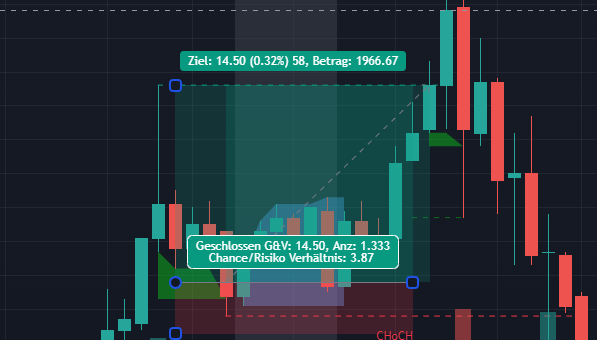

Fair Value Gap Example

The chart above shows three Fair Value Gaps. The first FVG on the left is a great example, how the FVG can be traded profitably. The green area shows the FVG. In this example the whole FVG has a size of 13 Ticks – so it’s gigantic to enter the Long Trade just at the FVG. That’s why I enter the trade at 50%. Just as I show it on the Trading View Chart. Target is the local last high. Stop Loss is the 1 Tick below the candle, that formed the FVG. Quite Aggressive. As you can see at the Chart, the TP is 58 Ticks, SL is 18 Ticks. The CRV is 3.87. A great trade!

Now let’s take the second example. Furthermore, here we have a massive FVG. So we enter the short trade at 50% of the FVG. The SL is also 1 Tick above the candle, that created the Gap itself. TP was a significant level for me, I found in a higher time frame. TP is 65 Ticks, SL is 26 Ticks. CRV is 2.5.

But as you can see, the market didn’t move in the expected direction. That’s why not just an entry is important but also a great trade management. I trade the FVG this way:

If the FVG wasn’t respected, I go break even. This is why this trade was not a loosing trade, but just a Break Even trade.

And here we have the third example. As you can see, the price didn’t tap into the FVG. And because of our discipline and self obligated rules, there is no trade. One essential thing is, not to learn how to trade. But to learn when not to trade. And also get rid of FOMO. This is one example, when not to trade.

What is a Fair Value Gap?

First we have to understand, how a market works and what moves the price on the market. There are two kinds of orders a trader can place. The aggressive Market Order and a passive Limit Order. And there is only one way to trade: The aggressive Market Order has to be matched with the passive Limit Order.

Just for clarity: A Limit Order is a wish to buy or sell at a fixed price. A Market Order is a wish to buy or sell NOW. And please remember: The Stock Market is a Zero-sum game. To buy something, you always need a seller. And to sell something, you always require a buyer.

Now we have to talk a little bit about price movement. Please imagine, you are in a Turkish bazaar. Very often, you will have similar prices for the offered goods. Now a group of tourists arrived at the market. And every one wants to buy a special product. A cup with the logo of the city, for example. The group arrives at the first store and buys everything there. The dealer in the second store sees the situation and thinks: Well, I increase the price of cups, I sell. Soon the first dealer has no more cups and the tourists go to the second store and here they buy the cups for the higher price. So the market price of the cup increased.

This situation is observed by the third dealer and the thinks: I’m going to double the price! And I will make a fortune. Some time later, the second dealer is sold out, and the tourists are going to the third dealer. Here they see the unfair price and just give him the finger. They are not willing to buy for this price.

But suddenly the first dealer found another box with the cups in his warehouse and said: I’m not concerned about these cups anymore. I just want to get rid of it. I sell them at the price, I was always selling them. So now the Market Price decreased again.

This is, what moves the price. Now we have to talk about two other terms:

Imbalance – When on the aggressive Side of the Market, are more orders than on the passive side.

Inefficiency – When the passive Side of the Market can’t provide enough orders for the aggressive side.

BISI - bullish Fair Value Gap

SIBI - bearish Fair Value Gap

Fair Value Gap Trading Strategy

There are several Trading Strategies, that use the element of the Fair Value Gap to get the direction right. The FVG is just one element of it. Or the final element to enter a trade. It should never be the only “indicator” to enter a trade. But with the FVG, there are strategies with a Win-Rate of about 80% possible.

As I already mentioned, the FVG has two functions in a trading strategy.

The Magnet

The primary function of the Fair Value Gap (FVG) is that of a magnet, attracting liquidity. Within the FVG resides unclaimed liquidity, and other market participants are eager to claim it. Allow me to illustrate with an analogy.

Imagine you’re strolling through a Turkish bazaar. After a lengthy walk under the sun, you’re craving a refreshing soda. You approach the first establishment: a chic, air-conditioned eatery where you’re offered a brand-name Coca-Cola served in a lavish golden glass. The price tag? 5 USD. A glance around reveals that the place is bustling — clearly, there are those who find the price reasonable for such an experience.

You decide to explore further and enter the next eatery. This one has worn-out furniture, and the air is thick with the smell of frying oil. But it’s clean. Here, a Pepsi is available for just 1 USD — a fair price, evidenced by the number of patrons filling the tables.

Outside on the street, a vendor with a backpack brimming with bottles offers a generic cola in a plastic cup for a mere 50 cents. He too has a group of customers happy to make a purchase at that price.

However, none of these options suit you. You desire a chilled Coca-Cola, served in a comfortable, modern setting, and poured into a glass cup, all for a moderate 2-3 USD. Sadly, there’s no vendor catering to this specific demand at your desired price.

Drawing a parallel to the stock market, this unmet demand represents a gap. There simply weren’t enough transactions executed at this price level. Gaps, more often than not, get filled. This is why a market gap inherently acts as a magnet, pulling the price toward it.

Resistence

The second function of a Fair Value Gap (FVG) is to act as resistance. The underlying idea is that an FVG pulls the market towards it, much like a magnet. However, there shouldn’t be a full candle close through the FVG. If a full candle does close inside an FVG, it negates the entire setup. Conversely, a wick might extend into the FVG, effectively tapping into its liquidity.

Think of this resistance in terms of a larger time frame. Picture it like a bus driver who has inadvertently left someone behind at a rest stop. The driver returns to collect the passenger, and then the journey resumes in the original direction. Using the same bus analogy, occasional disruptions might occur, leading everyone to terminate the journey and head home.

It’s worth noting that the market is more likely to respect the FVG when observed on a higher time frame compared to a lower one.

How to trade Fair Value Gap

A strategy to consider when trading an FVG is the ICT’s Silver Bullet. This approach has specific rules that need to be adhered to.

Firstly, trades should occur within what’s referred to as the “ICT Kill Zone”. This Kill Zone is a distinct time frame that spans during the London, AM NY, and PM NY sessions. Each Kill Zone lasts for an hour, which means the potential setup might emerge up to three times daily.

Secondly, there must be a liquidity grab. Referring to the screenshot, you can observe the previous low that took place during the Pre-Market Session and the Asia Range. The liquidity beneath this low was accessed.

Thirdly, a displacement is required. In ICT terminology, “Displacement” refers to a pronounced momentum shift in the market towards our preferred direction. I’ve highlighted this occurrence on the chart.

Next, there should be a CHoCH – or Change of Character. This indicates a disruption in the market structure. Almost concurrently, an FVG materialized, giving us our desired setup.

It’s worth noting that this example is slightly outside the bounds of the ICT Kill Zone, which concluded at 11 am NY time. Nevertheless, I opted to enter the trade. Our entry point is the FVG, the stop loss (SL) is positioned just below the swing low, and the take profit (TP) target is a high point, in anticipation of a bullish liquidity sweep.

By 11:02, our trade was triggered, even if slightly outside the ICT Kill Zone. By 11:19, our TP was hit, yielding a 43-tick profit. It’s worth remembering that 43 ticks translate to $537.50 when trading a single ES Contract.