Understanding Displacement in Trading: The ICT Perspective

Displacement: In the dynamic world of trading, one term that has gained traction among enthusiasts and professionals alike is “Displacement.” Originating from the Inner Circle Trader (ICT) concepts, displacement is a cornerstone idea that can help traders discern potential entry or exit points. However, like every trading principle, it should be understood deeply before application.

What is Displacement ?

At its core, displacement revolves around two pivotal components:

- Established Price Level or Range: Before any displacement can occur, the market needs to be in a recognizable state of equilibrium. This state is known as a range where prices oscillate within a defined upper and lower boundary. This range acts as the playing field on which displacement will eventually manifest.

- High Momentum Movement: The second part of displacement is the rapid shift from this established range. This high momentum movement can either be bullish (upward) or bearish (downward). It’s a signal, a sort of wake-up call, indicating that the market is moving away from its comfort zone.

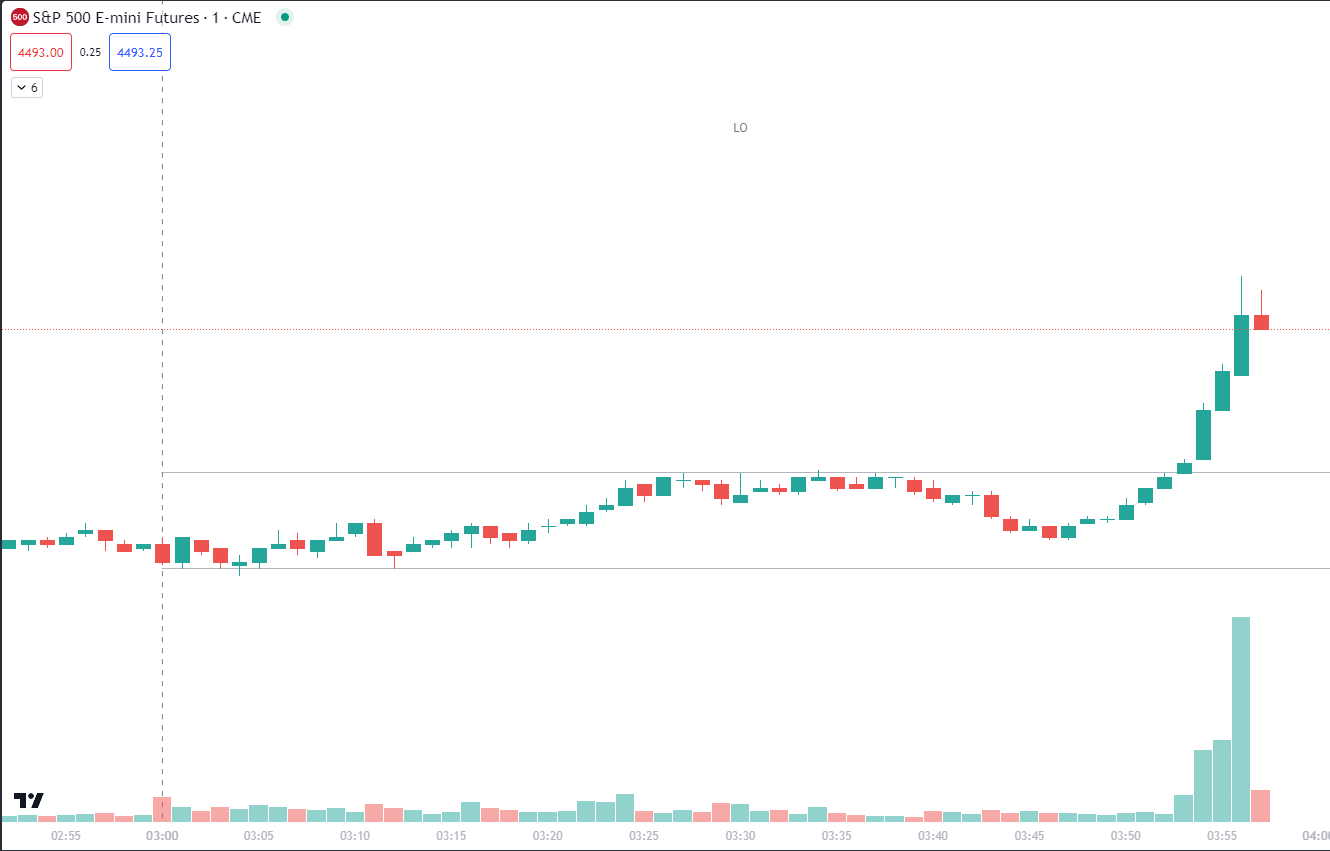

Bullish Displacement

A bullish displacement represents a sudden and robust upward shift from an established price range or level. It indicates strong buying momentum, often resulting from positive news, strong company earnings, or overall bullish market sentiment. In the context of the ICT concepts, a bullish displacement typically signifies the dominant presence of buyers or institutions pushing prices up. This type of displacement usually occurs after a consolidation phase or a bearish trend, suggesting a potential change in the market direction. Recognizing a bullish displacement early can be an essential tool for traders, offering insights into potential long-entry points or confirming existing bullish strategies.

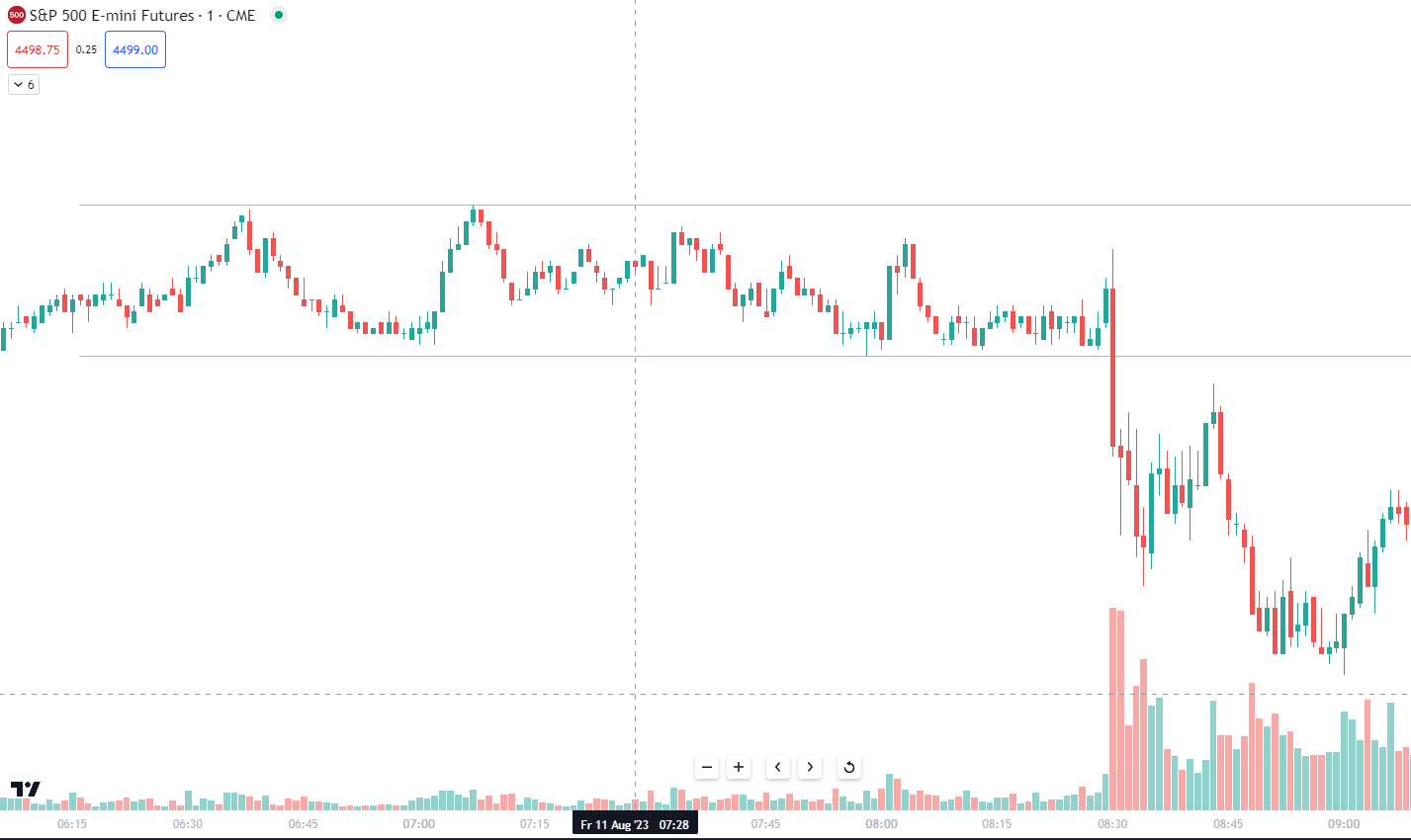

Bearish Displacement

Bearish displacement, in contrast, denotes a swift and significant downward move from a defined price range or level. It’s a reflection of dominating selling momentum in the market, possibly triggered by negative economic data, geopolitical tensions, or weakening company fundamentals. In line with ICT concepts, a bearish displacement showcases the overpowering influence of sellers or large institutions aiming to drive prices lower. Such displacements often follow a bullish trend or a consolidation phase, hinting at a potential market reversal. For traders, identifying a bearish displacement can provide valuable clues about short-selling opportunities or validate existing bearish trading positions.

Displacement and Other ICT Concepts

One of the remarkable aspects of the ICT methodology is how interconnected its concepts are. Displacement doesn’t operate in a vacuum; it’s closely related to other ICT ideas, such as:

- Order Block Theory: This theory posits that before significant market moves (like a displacement), there are specific areas where institutional traders place their orders. Recognizing these ‘order blocks’ can provide insights into potential displacements.

- Kill Zones: Another key ICT concept, Kill Zones refer to specific timeframes when trades are more likely to be profitable. Pairing the understanding of displacement with the timing of kill zones can enhance the efficiency of trading strategies.

Displacement: A Piece of the Puzzle

It’s vital to understand that displacement, while crucial, should never singularly define a trading strategy. It’s a piece, albeit a significant one, of a much larger framework. For instance, the ICT Silver Bullet strategy doesn’t just rely on displacement. It incorporates it as part of a broader set of rules and ideas that together form a cohesive trading approach.

Using displacement as the sole basis for trading would be akin to seeing a tree and missing the forest. The market’s intricacies are vast, and while displacement offers a lens to view a segment of it, it’s just one among many tools in a trader’s arsenal.

In Conclusion

Displacement, with its emphasis on established ranges and high momentum shifts, provides traders with a nuanced way to interpret market movements. While it holds immense value, it’s crucial to position it correctly within the broader ICT framework and, more extensively, within the trading world.

One must remember that the market is an intricate tapestry of forces, strategies, and events. Displacement offers a way to understand a part of it, but the real advantage comes from integrating this understanding with other concepts and strategies. Like the intertwining threads of a tapestry, the true beauty and utility of the ICT concepts, including displacement, come to the fore when they are viewed and employed together.